Unlock the Power of Term Insurance: Essential Protection You Can’t Overlook

It can be an effective and affordable solution for many clients. By Sabine Jensen

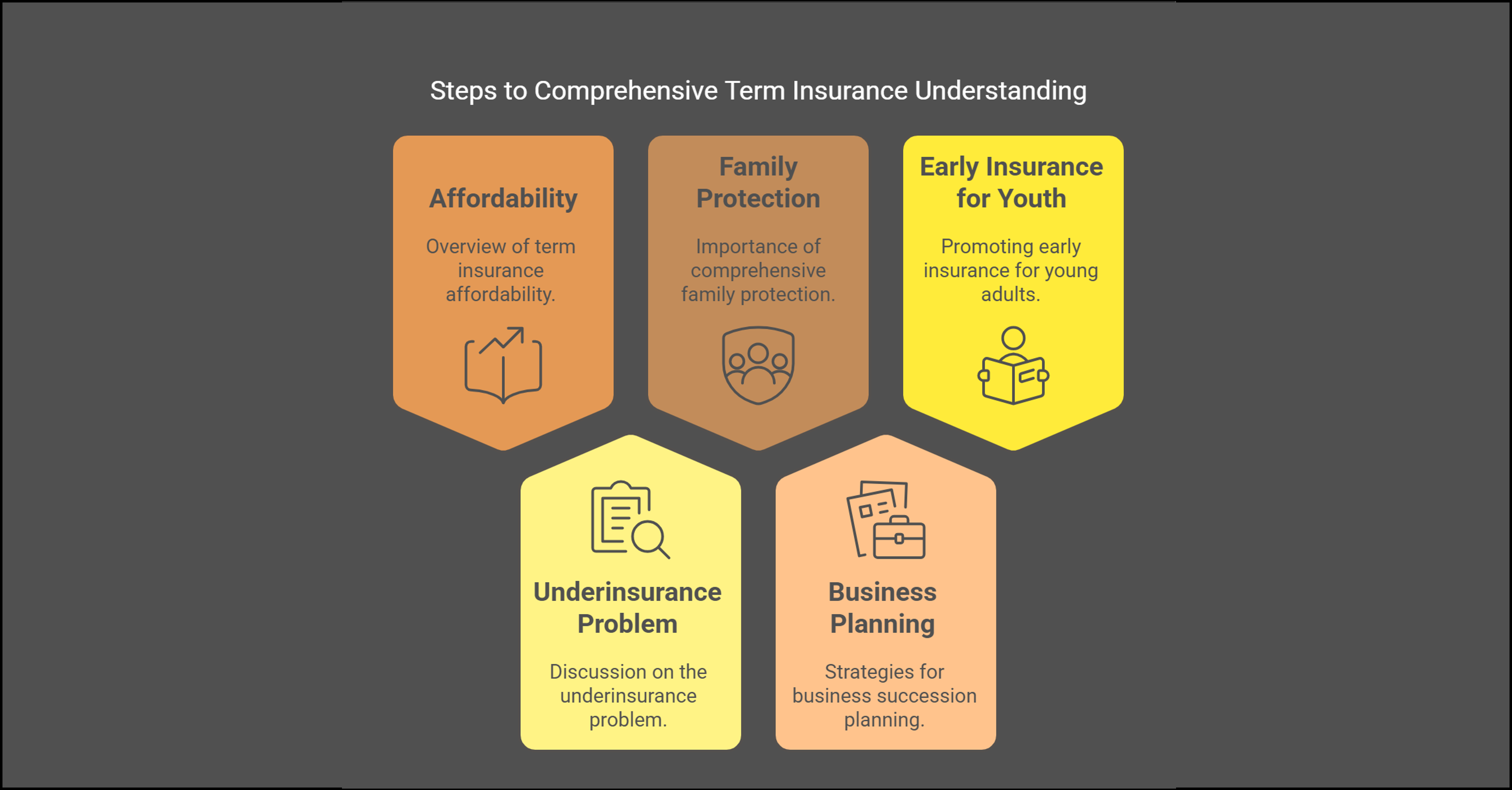

1. Introduction to Term Insurance Affordability

Term insurance is often overlooked due to misconceptions about its cost, yet it stands out as one of the most affordable forms of life insurance available. Unlike permanent life insurance policies, which combine a death benefit with a savings component, term insurance focuses solely on providing coverage for a specified period, typically ranging from 10 to 30 years. This streamlined approach allows insurers to offer policies at significantly lower premiums, making it accessible to a broader audience.

The affordability of term insurance is a revelation for many individuals who initially assume that life insurance is a costly investment. This misconception can deter people from exploring their options, leaving them and their families financially vulnerable. However, once they discover the cost-effectiveness of term insurance, they often reconsider its potential benefits. For example, a healthy 30-year-old might secure a $500,000 policy for as little as $20 to $30 per month, a small price to pay for peace of mind.

Recognizing the value of term insurance prompts individuals to take proactive steps in safeguarding their family’s financial future. It provides a safety net that ensures loved ones are protected from financial hardship in the event of the policyholder’s untimely death. This protection can cover essential expenses such as mortgage payments, education costs, and daily living expenses, allowing families to maintain their standard of living during difficult times.

Moreover, the simplicity of term insurance makes it an attractive option for those new to life insurance. With straightforward terms and conditions, policyholders can easily understand their coverage and make informed decisions. This transparency helps demystify the insurance process, encouraging more people to consider it as a viable option for financial security.

In summary, the affordability of term insurance is a key factor in its appeal. By dispelling myths about its cost, more individuals can appreciate its value and take steps to protect their families. As awareness grows, term insurance continues to play a crucial role in providing accessible and reliable financial security for people from all walks of life.

2. The Underinsurance Problem

Underinsurance is a pervasive issue that affects a large portion of the population, leaving many families exposed to financial risk in the event of an unexpected loss. Despite the availability of affordable options like term insurance, a significant number of individuals remain inadequately covered, often due to misconceptions about cost, complexity, or necessity.

Statistics reveal that many people either lack sufficient life insurance coverage or have none at all. This gap in coverage can have dire consequences for families, who may struggle to meet financial obligations such as mortgage payments, education costs, and daily living expenses if a primary income earner passes away. The emotional toll of losing a loved one is compounded by the financial strain, making it difficult for families to maintain their standard of living and plan for the future.

Several factors contribute to the underinsurance problem. One common barrier is that some individuals may not qualify for insurance due to health issues or other risk factors. However, these cases are exceptions rather than the norm. Most people, particularly those in good health, can access affordable term insurance policies that provide essential financial protection.

Another contributing factor is the complexity of the insurance market, which can be daunting for those unfamiliar with the industry. The variety of policy types, coverage options, and terms can overwhelm potential buyers, leading them to postpone or forgo purchasing insurance altogether. Simplifying the process and providing clear, accessible information can help demystify life insurance and encourage more people to obtain adequate coverage.

Ultimately, addressing the underinsurance problem requires a concerted effort to educate the public about the importance and affordability of life insurance. By dispelling myths and providing straightforward guidance, individuals can be empowered to make informed decisions that protect their families’ financial well-being. Emphasizing the value of term insurance as a cost-effective solution can help bridge the coverage gap and ensure that more families are prepared for the unexpected.

3. Ensuring Comprehensive Family Protection

When considering life insurance, many people focus primarily on the primary breadwinner, often overlooking the importance of insuring all family members. However, comprehensive family protection involves recognizing the value and contributions of each member, regardless of their income status. This holistic approach ensures that the family remains financially secure in the face of unexpected events.

Non-income-earning family members, such as stay-at-home parents, play a vital role in maintaining the household. Their contributions, though not directly tied to a paycheck, are invaluable. They manage daily tasks, provide childcare, and support the emotional and logistical needs of the family. In the event of their absence, the cost of replacing these services can be substantial, impacting the family’s financial stability. Insuring these members helps cover expenses such as childcare, housekeeping, and other essential services, allowing the family to maintain its routine and quality of life.

Additionally, insuring children can be a strategic move for long-term financial planning. While the immediate need for life insurance on children may not be apparent, securing a policy while they are young and healthy can lock in low rates and guarantee their insurability in the future. This foresight can be particularly beneficial if health issues arise later in life, potentially making it difficult or costly to obtain coverage.

Moreover, insuring all family members provides peace of mind. It ensures that, in the event of a tragedy, the family can focus on healing and recovery without the added stress of financial burdens. This comprehensive coverage acts as a safety net, offering reassurance that the family’s financial needs will be met, regardless of who is affected.

In conclusion, comprehensive family protection through life insurance is about more than just covering the primary income earner. It involves recognizing the diverse contributions of each family member and ensuring that their roles are financially safeguarded. By adopting this inclusive approach, families can better prepare for the unexpected and secure their financial future.

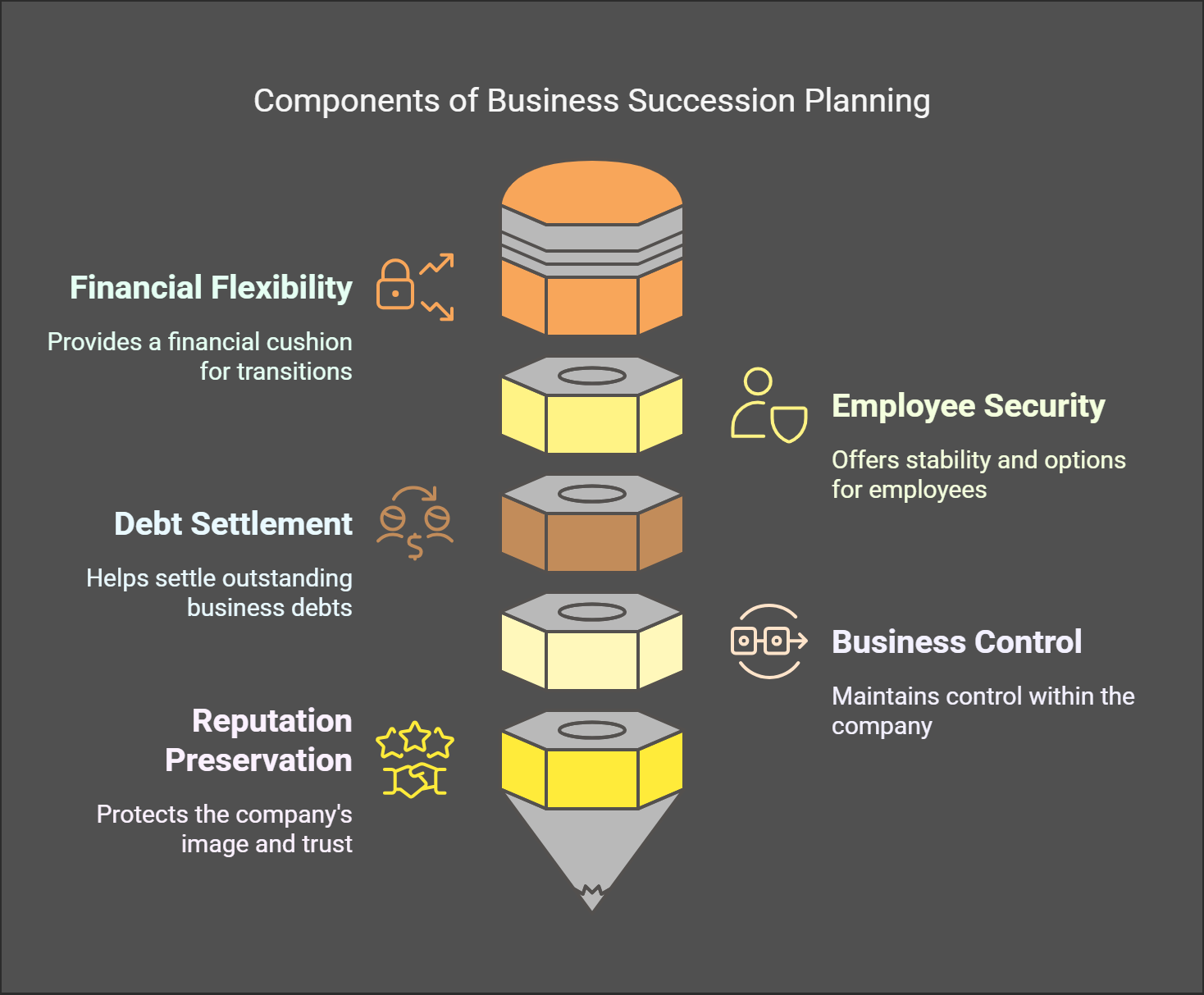

4. Business Succession Planning

Business succession planning is a critical aspect of ensuring the longevity and stability of a company, particularly in the event of an owner’s unexpected passing. Term insurance is a powerful tool in this planning process, offering a cost-effective way to safeguard the future of the business and provide financial security for both the company and its employees.

One of the primary benefits of incorporating term insurance into business succession planning is the financial flexibility it provides. By securing term insurance policies on key individuals, such as business owners or essential employees, companies can ensure that there is a financial cushion available to address immediate needs and facilitate a smooth transition. This coverage can be used to settle outstanding debts, cover operational expenses, or provide a financial buffer during the transition period.

For employees, term insurance can offer a sense of security and stability. In the event of an owner’s death, the policy’s payout can be used to fund a buy-sell agreement, allowing remaining partners or employees to purchase the deceased owner’s share of the business. This arrangement helps prevent external parties from acquiring a stake in the company, ensuring that control remains with those who are most invested in its success.

Moreover, term insurance can be structured to provide employees with options. For instance, the policy’s proceeds can be used to offer employees the choice to continue running the business or to receive a payout if they decide to pursue other opportunities. This flexibility is crucial in maintaining morale and ensuring that employees feel valued and supported during a potentially challenging time.

In addition to protecting the business’s financial interests, term insurance can also play a role in preserving the company’s reputation and client relationships. A well-executed succession plan, backed by adequate insurance coverage, demonstrates to clients and stakeholders that the business is prepared for unforeseen events and committed to continuity. This assurance can help maintain trust and confidence in the company’s ability to deliver consistent services and uphold its commitments.

In conclusion, term insurance is an essential component of business succession planning, providing the financial resources and flexibility needed to navigate the complexities of ownership transitions. By proactively incorporating term insurance into their succession strategies, business owners can protect their legacy, support their employees, and ensure the long-term success of their enterprises.

5. Encouraging Early Insurance for Young Adults

Securing life insurance early in life is a strategic decision that can offer significant long-term benefits. Encouraging young adults to obtain term insurance while they are still in good health is a proactive approach that can safeguard their financial future and provide peace of mind for both them and their families.

One of the primary advantages of purchasing term insurance at a young age is the cost-effectiveness. Insurance companies typically offer the most favorable rates to young, healthy individuals because they are considered lower risk. By locking in these low premiums early, young adults can enjoy substantial coverage at a fraction of the cost they might face if they wait until later in life, when health issues or age could increase their premiums.

Additionally, obtaining insurance early ensures that young adults are protected against unforeseen circumstances. Life is unpredictable, and having a term insurance policy in place provides a financial safety net that can cover expenses such as outstanding debts, funeral costs, or even future family needs. This protection is invaluable, offering reassurance that loved ones will not be burdened financially in the event of an untimely death.

Another critical aspect of early insurance is the guarantee of insurability. As individuals age, they may develop health conditions that could make it difficult or even impossible to obtain life insurance. By securing a policy while they are young and healthy, individuals can ensure that they have coverage regardless of any future health changes. This foresight can be particularly beneficial if they later decide to convert their term policy to a permanent one, as many term policies offer conversion options without requiring additional medical underwriting.

Moreover, encouraging young adults to purchase life insurance fosters financial responsibility and planning. It introduces them to the concept of risk management and the importance of protecting their financial interests. This early exposure can set the foundation for sound financial habits and decision-making throughout their lives.

Parents and guardians can play a pivotal role in this process by educating their children about the benefits of life insurance and even assisting with the initial premium payments. This support can make it easier for young adults to prioritize insurance as part of their financial strategy, ensuring they are well-prepared for the future.

In summary, encouraging young adults to secure term insurance early is a wise investment in their financial security. By taking advantage of favorable rates and ensuring insurability, they can protect themselves and their families from potential financial hardships, laying the groundwork for a stable and secure future.

Conclusion: The Value of Term Insurance

Term insurance stands as a cornerstone of financial security, providing a straightforward and effective means of safeguarding families against the uncertainties of life. Its value lies in its simplicity, affordability, and the peace of mind it offers, making it an indispensable tool for financial planning across generations.

At its core, term insurance is designed to provide financial protection for a specified period, typically ranging from 10 to 30 years. This focused approach allows policyholders to secure substantial coverage at a lower cost compared to permanent life insurance options. As a result, families can allocate their financial resources more efficiently, ensuring that they have adequate protection without overextending their budgets.

One of the most significant benefits of term insurance is its ability to act as a financial safety net during critical life stages. Whether it’s covering the mortgage, funding a child’s education, or replacing lost income, term insurance provides the necessary funds to help families maintain their standard of living in the face of adversity. This protection is crucial, as it allows loved ones to focus on healing and rebuilding their lives without the added stress of financial burdens.

Moreover, term insurance is highly adaptable, making it suitable for a wide range of financial situations and life stages. Young families can use it to protect against the loss of a primary breadwinner, while older individuals might leverage it as part of their estate planning strategy. Its flexibility ensures that it can be tailored to meet the unique needs of each policyholder, providing targeted protection where it’s needed most.

In addition to its practical benefits, term insurance also offers emotional reassurance. Knowing that there is a plan in place to protect loved ones in the event of an untimely death provides a sense of security and peace of mind. This emotional comfort is invaluable, as it allows individuals to live their lives with confidence, knowing that their family’s future is safeguarded.

Despite its many advantages, term insurance is sometimes underrated or overlooked in favor of more complex financial products. However, its straightforward nature and proven effectiveness make it a vital component of any comprehensive financial plan. By recognizing and embracing the value of term insurance, individuals can ensure that they are well-prepared to face life’s uncertainties, providing a lasting legacy of protection and security for their families. Term insurance is more than just a financial product; it is a commitment to protecting the well-being of loved ones. Its role in providing a reliable safety net cannot be overstated, as it ensures that families are cared for in times of need, offering both financial stability and peace of mind. As such, it is essential not to underrate its value, but rather to appreciate and utilize it as a fundamental element of financial security for generations to come.

One response

[…] Unlock the Power of Term Insurance: Essential Protection You Can’t Overlook […]