Are Term Life Insurance Proceeds Taxable?

By Sabine Jensen

Today we’re diving into a topic that might seem a bit dry but is super important if you’re dealing with life insurance: Are life insurance proceeds taxable? Let’s break it down in simple terms.

Understanding Life Insurance Proceeds

First things first, let’s talk about what happens when a life insurance policy pays out. Generally, if you’re the beneficiary of a life insurance policy, the proceeds you receive aren’t taxable. That’s right, you usually don’t have to pay taxes on that money. But, like most things in life, there are exceptions.

When Are Life Insurance Proceeds Taxable?

Payout Structure:

If the death benefit is paid in installments rather than a lump sum, the interest earned on these installments is taxable. So, if you choose to receive the money over time, be prepared to pay taxes on the interest.

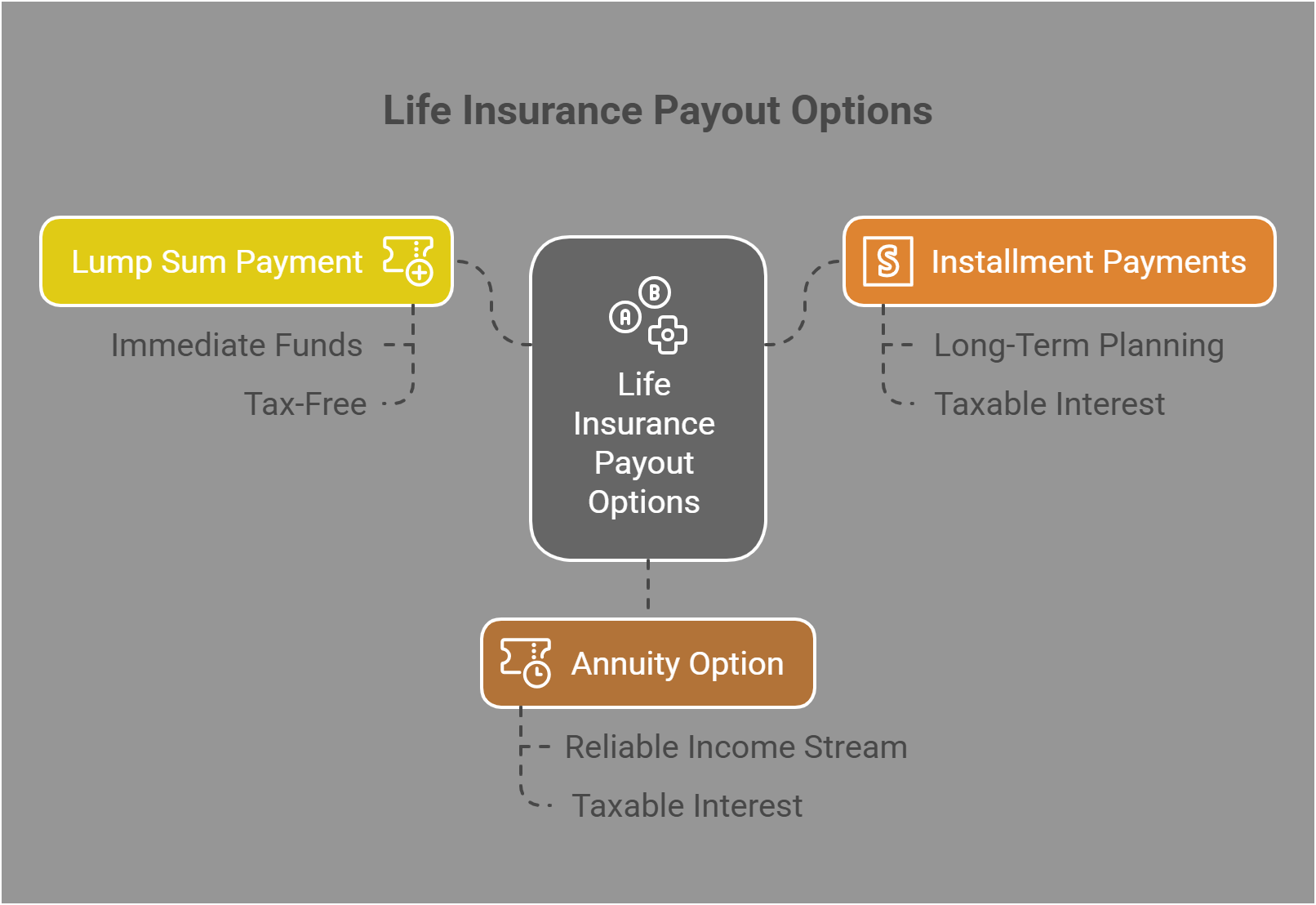

Lump Sum Payment: The most common payout structure is the lump sum payment. In this arrangement, the beneficiary receives the entire death benefit at once. This option is straightforward and provides immediate access to funds, which can be used to cover funeral expenses, pay off debts, or invest for future needs. One of the key advantages of a lump sum payment is that it is typically tax-free, allowing beneficiaries to utilize the full amount without worrying about income taxes.

Installment Payments: Alternatively, beneficiaries may choose to receive the proceeds in installments over a specified period. This option can provide a steady stream of income, which might be beneficial for long-term financial planning. However, it’s important to note that while the principal amount of the death benefit is not taxable, any interest earned on the installments is subject to income tax. Beneficiaries should consider their current and future financial needs when deciding on this payout structure.

Annuity Option: Another option is to convert the death benefit into an annuity, which provides regular payments for a set number of years or for the lifetime of the beneficiary. This can be an attractive choice for those seeking a reliable income stream, especially in retirement. Like installment payments, the interest portion of annuity payments is taxable, so beneficiaries should plan accordingly.

Withdrawals or Loans:

If the policyholder withdraws more than the total premiums paid or takes out a loan against the policy, the excess might be taxable.

Withdrawals from the Policy: Withdrawals from a life insurance policy refer to taking out a portion of the cash value that has accumulated over time. Generally, withdrawals up to the amount of premiums paid are not taxable, as they are considered a return of the policyholder’s investment. However, if the withdrawal exceeds the total premiums paid, the excess amount is considered taxable income. This is because the excess represents earnings or gains on the policy, which are subject to income tax.

Loans Against the Policy: Taking out a loan against a life insurance policy is another way to access the cash value. These loans are typically tax-free, as they are not considered income but rather a debt that the policyholder must repay. The policy’s cash value serves as collateral for the loan. However, if the policy lapses or is surrendered before the loan is repaid, the outstanding loan amount may become taxable. This occurs because the unpaid loan is treated as a distribution, and any amount exceeding the premiums paid is taxable.

Surrendering the Policy:

If you decide to surrender your policy, any amount you receive over the policy’s cash basis is taxable as regular income.

Understanding Cash Basis and Tax Implications: The cash basis of a life insurance policy refers to the total amount of premiums paid into the policy. When a policy is surrendered, the policyholder receives the cash surrender value, which may exceed the cash basis if the policy has accumulated earnings over time. Any amount received above the cash basis is considered taxable income. This is because the excess represents the growth or earnings on the policy, which are subject to income tax.

Calculating Taxable Income: To determine the taxable portion of the surrender proceeds, policyholders need to subtract the total premiums paid (cash basis) from the cash surrender value. For example, if a policyholder has paid $20,000 in premiums and the cash surrender value is $30,000, the taxable income would be $10,000. This amount must be reported as regular income on the policyholder’s tax return, and the appropriate taxes must be paid.

Employer-Paid Plans:

Benefits from employer-paid plans exceeding $50,000 may be taxable.

Employer-paid life insurance plans are a common benefit offered by many companies, providing employees with financial protection at little or no cost to them. These plans typically involve group term life insurance, where the employer pays the premiums on behalf of the employees. While this benefit can be a valuable part of an employee’s compensation package, it’s important to understand the tax implications, especially when the coverage exceeds certain thresholds.

Tax Implications of Employer-Paid Life Insurance: Under current tax regulations, the cost of employer-provided group term life insurance coverage up to $50,000 is generally tax-free for employees. This means that employees do not have to report the value of this coverage as income, and it does not affect their taxable income. However, if the coverage amount exceeds $50,000, the cost of the excess coverage is considered taxable income and must be reported on the employee’s W-2 form.

Calculating Taxable Income: The taxable portion of employer-paid life insurance is determined using the IRS’s Uniform Premium Table, which assigns a cost per $1,000 of coverage based on the employee’s age. For example, if an employee has $100,000 in coverage, the taxable amount would be calculated on the $50,000 that exceeds the tax-free threshold. The cost of this excess coverage is then added to the employee’s taxable income, potentially affecting their overall tax liability.

Key Considerations for Employees: Employees should be aware of the potential tax implications of their employer-paid life insurance benefits, especially if the coverage exceeds $50,000. It’s important to review the details of the plan and understand how the taxable portion is calculated. Employees may also want to consider whether additional coverage is necessary or if they should explore other life insurance options that might better suit their needs without incurring additional tax burdens. Consulting with a tax advisor can provide clarity and help employees make informed decisions about their life insurance coverage and its impact on their financial situation.

Estate Taxes:

If the death benefit is included in the deceased’s estate and exceeds the federal estate tax threshold ($12.92 million as of 2023), estate taxes apply.

Understanding Estate Taxes: Estate taxes are levied on the total value of a deceased person’s estate before the assets are distributed to the heirs. As of 2025, the federal estate tax threshold is $13.99 million. This means that if the combined value of the estate, including the life insurance death benefit, exceeds this threshold, the excess amount is subject to federal estate taxes. The estate tax rate can be significant, potentially reducing the amount of inheritance received by the beneficiaries.

When planning an estate, it’s crucial to consider the potential impact of estate taxes on life insurance proceeds. Policyholders should evaluate their total estate value and explore strategies to minimize tax liabilities, such as establishing an ILIT or gifting the policy to another individual. Consulting with an estate planning attorney or financial advisor can provide valuable guidance in structuring an estate plan that aligns with personal goals and maximizes the benefits for heirs. By understanding the relationship between life insurance and estate taxes, individuals can make informed decisions to protect their legacy and ensure a smooth transfer of assets to their beneficiaries.

Goodman Triangle:

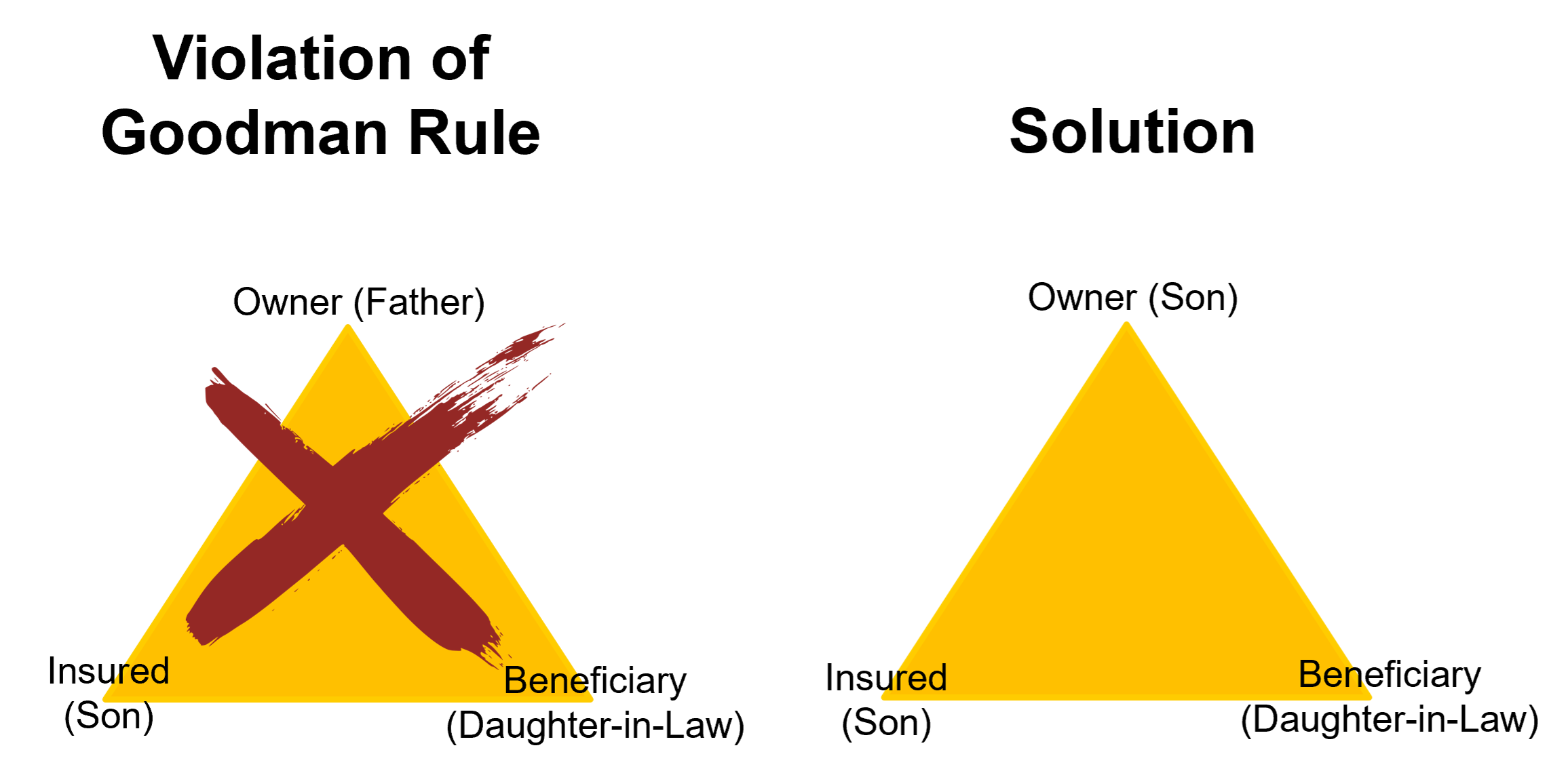

If the policyholder, insured, and beneficiary are three different people, the death benefit may be considered a taxable gift.

The Goodman Triangle is a concept in life insurance that applies to situations where the policyholder, insured, and beneficiary are distinct individuals. Under normal circumstances, the death benefit from a life insurance policy is not taxable to the beneficiary. However, the tax implications can become more complicated when the policyholder and the beneficiary are not the same person. If the policyholder purchases the life insurance for the benefit of someone else (e.g., a spouse or a child), and the insured person is someone entirely different, the IRS may treat the death benefit as a gift.

In such cases, if the death benefit is paid to the beneficiary, the transfer of wealth from the policyholder to the beneficiary could be viewed as a taxable gift. This can be problematic, as the policyholder might inadvertently exceed the annual gift tax exclusion amount, or the cumulative value of gifts may surpass the lifetime estate tax exemption, triggering potential gift tax liabilities.

This situation is important for individuals who are setting up life insurance policies where the intended beneficiaries differ from the policyholder and insured. It’s critical to understand the tax implications in order to avoid unintentional financial consequences. The Goodman Triangle illustrates the complexities of estate planning and tax laws that come into play when dealing with life insurance policies involving multiple parties. Consulting with a tax advisor or estate planner is often recommended to help navigate these potential tax obligations.

No responses yet