The Quest for the Best: Navigating the World of Term Life Insurance!

Exploring Differences and Options to Choose the Right Policy

By Sabine Jensen

When it comes to protecting your loved ones, term life insurance is a crucial component of a solid financial plan. It provides a safety net that ensures your family can maintain their standard of living in the event of an unexpected loss. However, with so many options available, choosing the right term life insurance policy can feel overwhelming. Which Term Life Insurance is the Best?

Understanding Term Life Insurance

Term life insurance is a straightforward and affordable way to provide financial protection for your loved ones in the event of your untimely passing. Unlike whole life insurance, which offers lifelong coverage and a cash value component, term life insurance is designed to cover you for a specific period—typically ranging from 10 to 30 years. This makes it an ideal choice for individuals who want to ensure their family’s financial security during critical years, such as while raising children or paying off a mortgage.

One of the key features of term life insurance is its simplicity. When you purchase a term policy, you agree to pay a set premium for the duration of the term, and in return, the insurer promises to pay a death benefit to your beneficiaries if you pass away during that period. This clear structure allows policyholders to easily understand what they are getting and what their loved ones will receive in the event of their death. Additionally, term life insurance is often more affordable than permanent life insurance options, making it accessible for a wider range of individuals and families.

Another important aspect to consider is that term life insurance can be tailored to fit your specific needs. Many policies offer the flexibility to convert to a permanent policy later on, should your circumstances change. This means that if you find yourself needing lifelong coverage as you age, you can transition your term policy without undergoing additional medical underwriting. Understanding these fundamental elements of term life insurance will empower you to make informed decisions as you explore your options and seek the best coverage for your family’s future.

Evaluating the Best Life Insurance Carriers

When it comes to selecting the best term life insurance policy, the choice of carrier is just as important as the policy itself. Not all insurance companies are created equal, and understanding the strengths and weaknesses of various carriers can significantly impact your overall experience and satisfaction. Key factors to consider when evaluating life insurance carriers include financial strength, customer service, claims processing, and policy options.

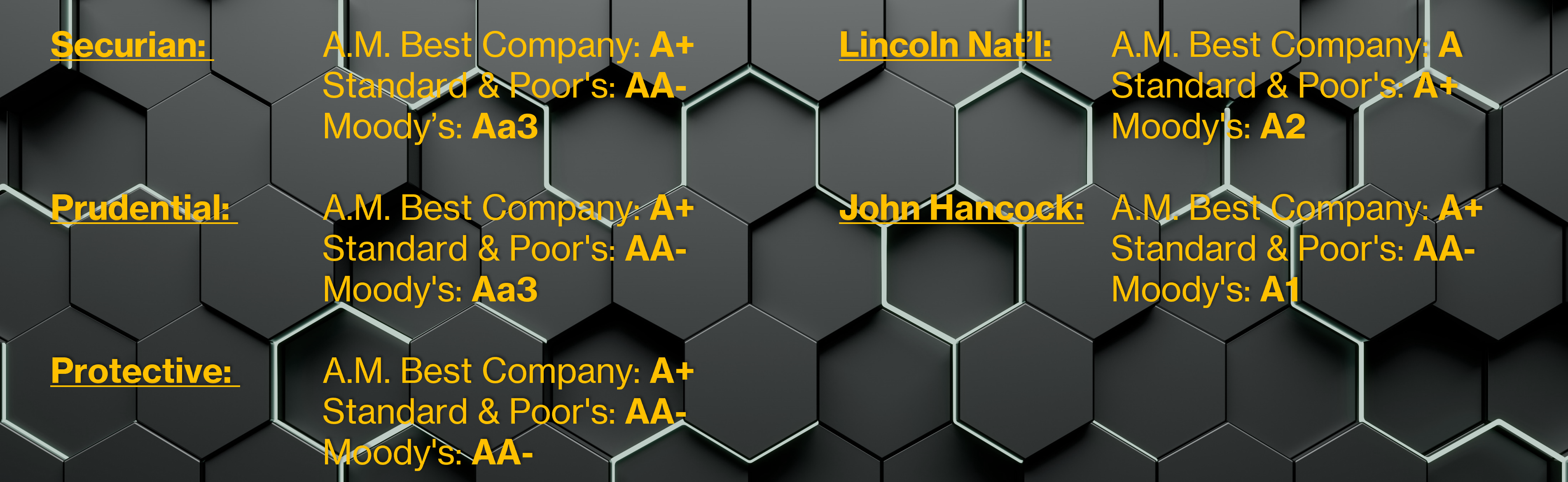

Financial strength is a critical consideration, as it indicates the insurer’s ability to pay claims when they arise. Independent rating agencies, such as A.M. Best, Moody’s, and Standard & Poor’s, provide ratings that reflect the financial stability of insurance companies. A carrier with a high rating is more likely to fulfill its obligations to policyholders, giving you peace of mind that your loved ones will be taken care of in the event of your passing.

A few highly rated carriers are:

Customer service is another vital aspect to consider. A responsive and helpful customer service team can make a significant difference when you have questions or need assistance with your policy. Look for carriers that have positive reviews and high customer satisfaction ratings. Additionally, consider the claims process—how easy is it for beneficiaries to file a claim, and how quickly are claims typically paid? A carrier with a streamlined claims process can alleviate stress during an already difficult time.

Finally, it’s essential to compare the policy options offered by different carriers. Some insurers may provide unique features or riders that can enhance your coverage, while others may have more flexible terms or lower premiums. By evaluating the various life insurance carriers based on these criteria, you can make an informed decision that aligns with your financial goals and ensures your family’s protection. In the next section, we’ll explore how to identify your individual needs to further refine your search for the perfect term life insurance policy.

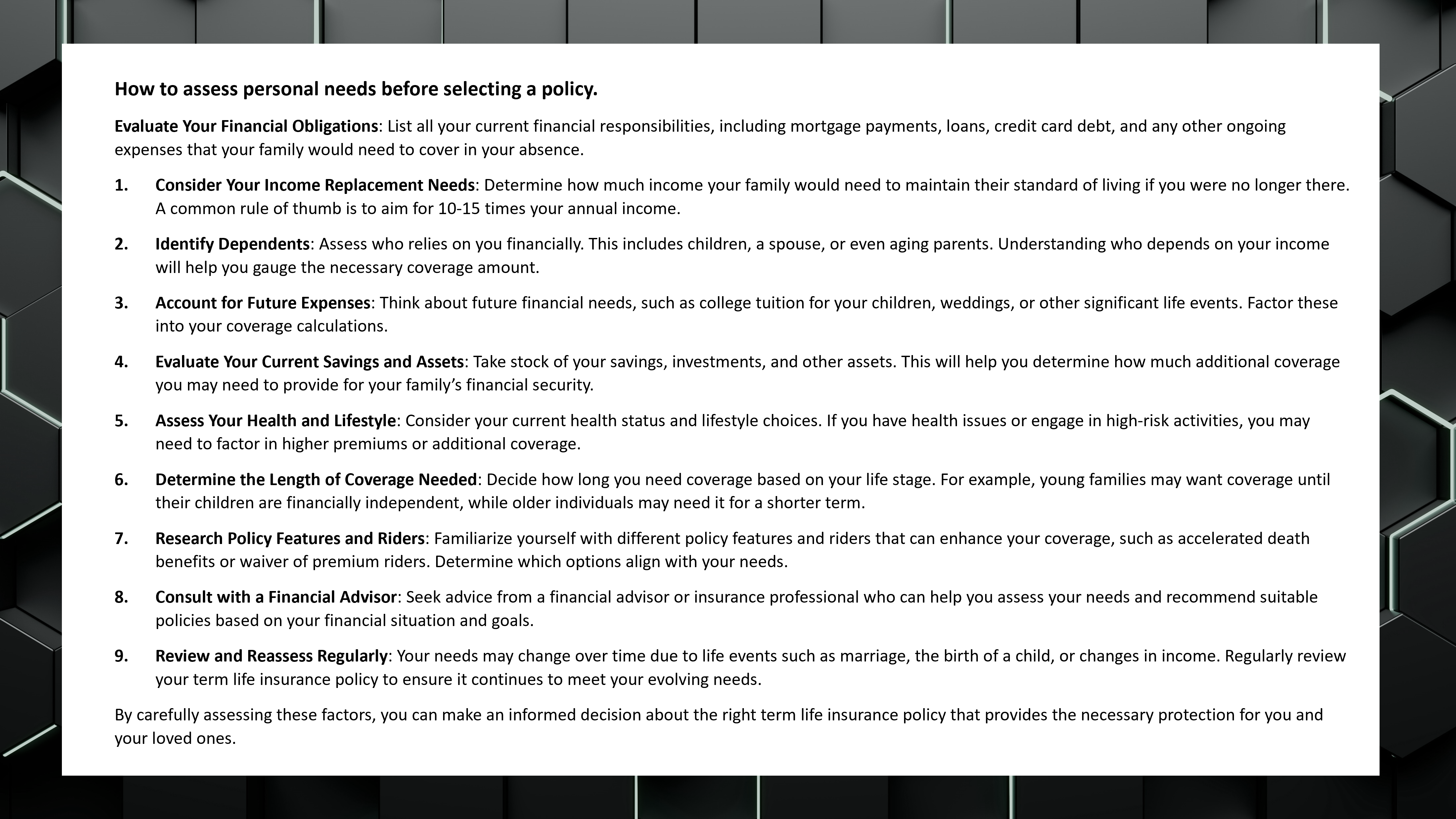

Identifying Individual Needs

Choosing the right term life insurance policy begins with a clear understanding of your individual needs and circumstances. Every person’s situation is unique, and what works for one family may not be suitable for another. By assessing your specific requirements, you can tailor your coverage to ensure that it adequately protects your loved ones and aligns with your financial goals.

For young families, the primary concern often revolves around income replacement. If you are the primary breadwinner, your sudden absence could leave your family struggling to meet daily expenses, mortgage payments, and educational costs for your children. In this case, a policy that provides a substantial death benefit for a term that covers the years until your children are financially independent is essential. Additionally, consider any debts you may have, such as student loans or credit card debt, which could also impact your family’s financial stability.

Single individuals, on the other hand, may have different priorities. While they may not have dependents, they might still want to ensure that their final expenses, such as funeral costs, are covered. A term life insurance policy can provide peace of mind, knowing that loved ones won’t be burdened with these costs. Furthermore, if you have significant debts, securing a policy that covers those obligations can help protect your estate and ensure that your assets are preserved for your beneficiaries.

Homeowners should also take their mortgage into account when selecting a term life insurance policy. A policy that covers the remaining balance of your mortgage can provide security for your family, ensuring they can stay in their home without the financial strain of mortgage payments.

Business owners may need to consider key person insurance or buy-sell agreements to protect their business interests and ensure continuity in the event of an unexpected loss. By identifying your individual needs and circumstances, you can make informed decisions about the type and amount of term life insurance coverage that will best serve you and your family’s future.

The Importance of Riders

When selecting a term life insurance policy, it’s essential to consider the various riders available, as they can significantly enhance your coverage and provide additional benefits tailored to your specific needs. Riders are optional add-ons that can be attached to your base policy, offering flexibility and customization that can adapt to your changing circumstances. Understanding the different types of riders and their advantages can help you make a more informed decision about your term life insurance.

One of the most popular riders is the Accelerated Death Benefit Rider. This rider allows policyholders to access a portion of their death benefit while they are still alive if they are diagnosed with a terminal illness. This can provide crucial financial support during a challenging time, allowing you to cover medical expenses, make necessary arrangements, or even fulfill lifelong dreams with your loved ones. Knowing that you have this option can bring peace of mind, knowing that your family will be taken care of, even if you face a serious health crisis. Some carriers provide this rider without additional cost.

Another valuable rider is the Waiver of Premium Rider. This rider ensures that if you become disabled and are unable to work, your premiums will be waived for the duration of your disability. This means you can maintain your coverage without the financial burden of premium payments during a difficult time. For many, this rider is a game-changer, as it provides a safety net that ensures your loved ones remain protected, even if you face unexpected challenges.

Additionally, riders such as the Child Rider can provide coverage for your children at a lower cost, ensuring that they are protected in the event of an unforeseen tragedy. This rider can often be converted to a permanent policy when your child reaches adulthood, providing them with lifelong coverage options. By incorporating riders into your term life insurance policy, you can create a comprehensive plan that addresses your unique needs and provides a robust safety net for your family.

One notable rider to consider is Securian’s Extended Conversion Rider. The Extended Conversion Agreement allows the term conversion period to be extended to the full duration of the level term period of the policy or to age 75, whichever comes first.

For Example: A 15 Year Term will only be convertible to a permanent policy for the first 5 years (if the insured will not be 75 within the first 5 years) With the rider the policy is convertible for 15 years or age 75.

This is particularly beneficial for individuals whose health may have changed since they first purchased their term policy. With the Securian’s Extended Conversion Rider, you can secure lifelong coverage at a time when it may be more challenging to obtain due to health issues.

In summary, riders are an essential aspect of term life insurance that can enhance your policy and provide additional layers of protection. By understanding the various riders available and how they can benefit you, you can tailor your coverage to ensure it meets your specific needs and offers peace of mind for you and your loved ones.

Understanding Conversion Options

Conversion options in term life insurance allow policyholders to transition their term policy into a permanent life insurance policy without undergoing additional medical underwriting. This flexibility is crucial, as it enables individuals to secure lifelong coverage even if their health status changes over time.

It is also important to learn which product each carrier offers for conversion. The importance of having a carrier that offers conversion to the entirety of their product portfolio cannot be overstated. This means that policyholders have the freedom to choose from a wide range of permanent insurance products, ensuring they can select the option that best fits their evolving needs and financial goals. By providing access to a diverse array of conversion products, carriers empower policyholders to make informed decisions that align with their long-term protection strategies.

3 Responses

[…] Which Term Life Insurance is the Best? […]

[…] Which Term Life Insurance is the Best? […]

[…] monthly cost of a $1 million Term life insurance policy can vary significantly based on several factors, including age, gender, health, and the type […]